Main services

The real success is not in executing the M&A transaction but in realizing the expected returns from the M&A investment.

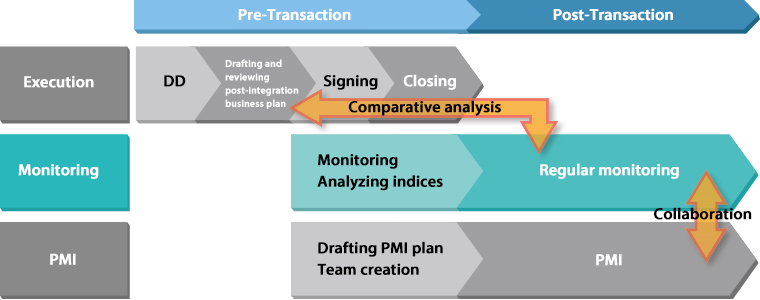

In order to succeed in an M&A transaction, not only is it important to execute a smooth PMI (Post Merger Integration) in the post-deal phase, but it is just as important to monitor the business on a regular basis. Although prior investment analysis is conducted for cases other than M&A such as capital expenditure and IT investments, there are not many cases of post transaction valuation. By conducting a valuation after the transaction, we believe that clients are better able to conduct effective PMI and strategy planning.

At G-FAS, we are able to support our clients after the deal has closed, through regular monitoring services which includes a comparative analysis of the business plan at the time of investment, based on the KPIs identified during the Businessman’s Review during the pre-deal process. Also, as part of the comprehensive support services, we work with PMI professionals based on the needs of the client.