Main services

In order to lead clients to a successful M&A transaction, we evaluate the target using the most appropriate method for the given situation. We also provide technical advice based on issues identified during due diligence as well as valuation and analysis of intangible assets for purchase price allocation in purchase accounting situations.

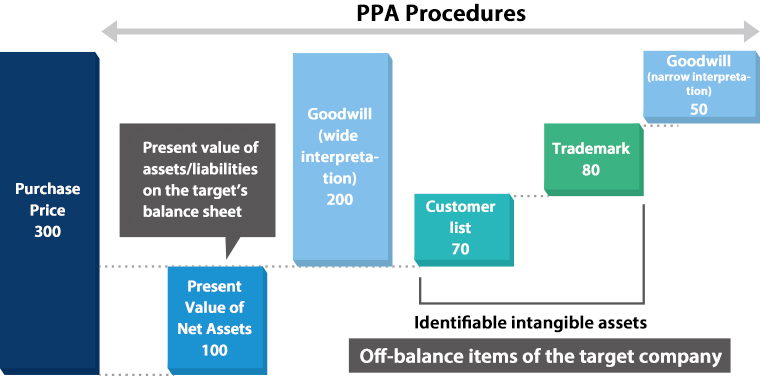

PPA(Purchase Price Allocation)

As the adoption deadline for international accounting standards is nearing, general M&A accounting practices are also facing a big change. For M&A, it is becoming ever more important to respond strategically to the probable impact on financial statements prior to and after an M&A transaction in anticipation of the expanded yearly impairment exposures due to the non-amortization of goodwill. Such measures include evaluating the appropriate allocation of intangible assets (such as trademarks and clients) to the purchase price when applying the purchase method and forming a monitoring model based on post-acquisition/consolidation scenario analysis among others. Additionally, by estimating the value of intangible assets at an early stage, it will be easier to define the purchase when deciding to make the investment.

With professionals who are experienced in purchase price allocation procedures under US GAAP, G-FAS has the capability to provide total support for its clients in their M&A strategies, including estimating the optimal and reasonable value of intangible assets, post-acquisition / consolidation synergy analysis and supporting impairment tests among others.